BMO Business Xpress (BBX)

BMO Bank of Montreal

Product Designer & UI Developer

Summary

BMO Business Xpress reduces the small business lending process from 30 days to 30 minutes. The project included discovering the current lending process, conducting research with small business banking specialists, designing user flows, platform implementation, and measuring its impact on employees and business customers.

Meet Emily

Emily is a BMO Bank of Montreal employee and works in a branch Downtown Toronto to help small businesses with their banking needs. She is a small business banking specialist and has been with BMO for 3 years.

A few of the pain points that Emily experienced with the previous process:

- No matter how much funding the customers were looking for, the long 30 day process was the same, including a visit to the business itself

- Emily was frustrated with losing customers to competitors and how this affects her livelihood due to performance based incentives

- Crunching the same financial calculations repeatedly and double checking to make sure she didn’t make any mistakes as it was a manual process

- Needing to use 12 different internal and external banking systems to create customer profiles, access records, credit reports, configure products and more.

- Communicating back and forther with different credit officers about complex applications

Context

The small business lending process at BMO Bank of Montreal took up to 30 days to process a loan application. This extended processing time impacted small business clients as most folks can’t wait that long for additional funding. BMO's small business banking specialists were losing to competitor banks who could fund small businesses in a single or few days.

BMO Bank of Montreal's goal was to simplify the lending process and reduce the processing time to 30 minutes, making it possible for any branch employee to process loan applications without requiring special training.

Problem

How might we simplify BMO’s small business lending process from 30 days to 30 minutes?

Research

We shadowed a small business lending expert for two days to understand the lending process and mapped their and the customer's journeys to identify pain points. Next, we partnered with business and legal teams to identify which parts of the process could be automated or removed.

Finally, we conducted focus groups and usability tests with small business banking specialists from coast to coast, exploring some of the following research questions:

- What tasks could be automated to speed up the application process?

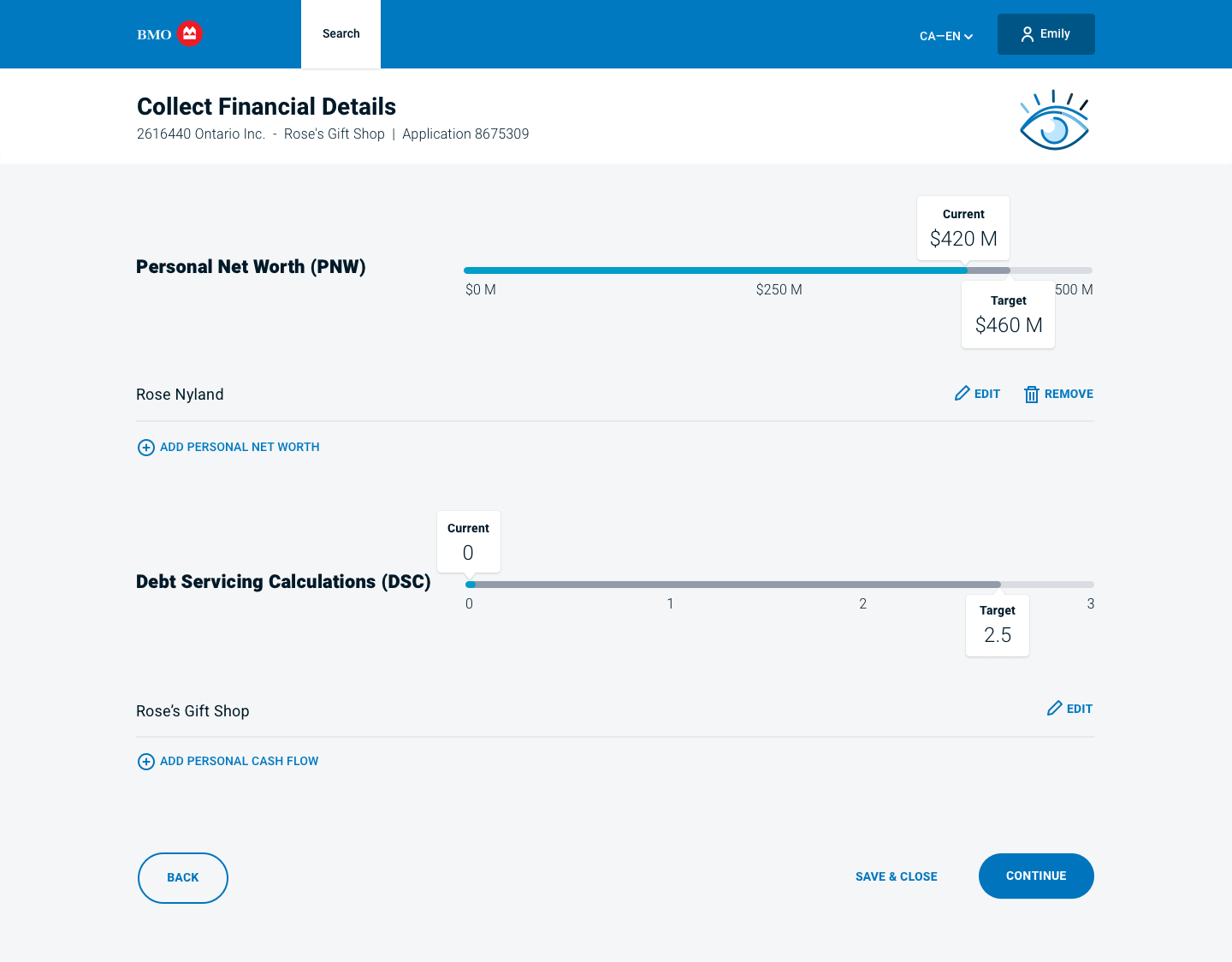

- Does the visual representation of these calculations make sense to the specialists?

- What is the most valuable information needed to review about a client before starting an application?

- What are the top reasons small businesses come to BMO for a loan or credit?

- What causes you to leave an application and return it? Is saving an application to be continued later crucial to you?

Design

Based on the research findings, we designed the following user flow for BMO Business Xpress:

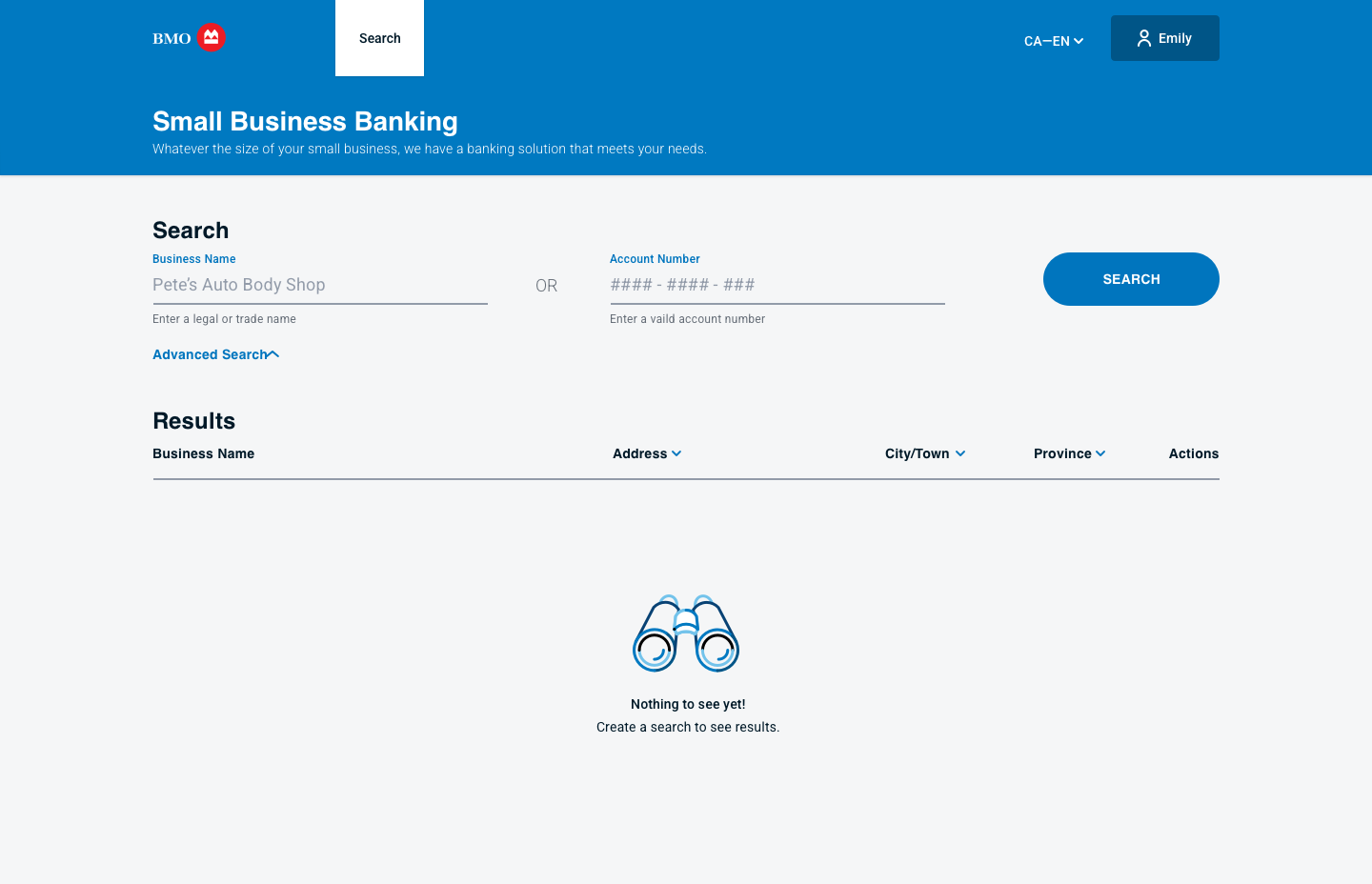

1. Search

Locate an existing small business customer or create a new one.

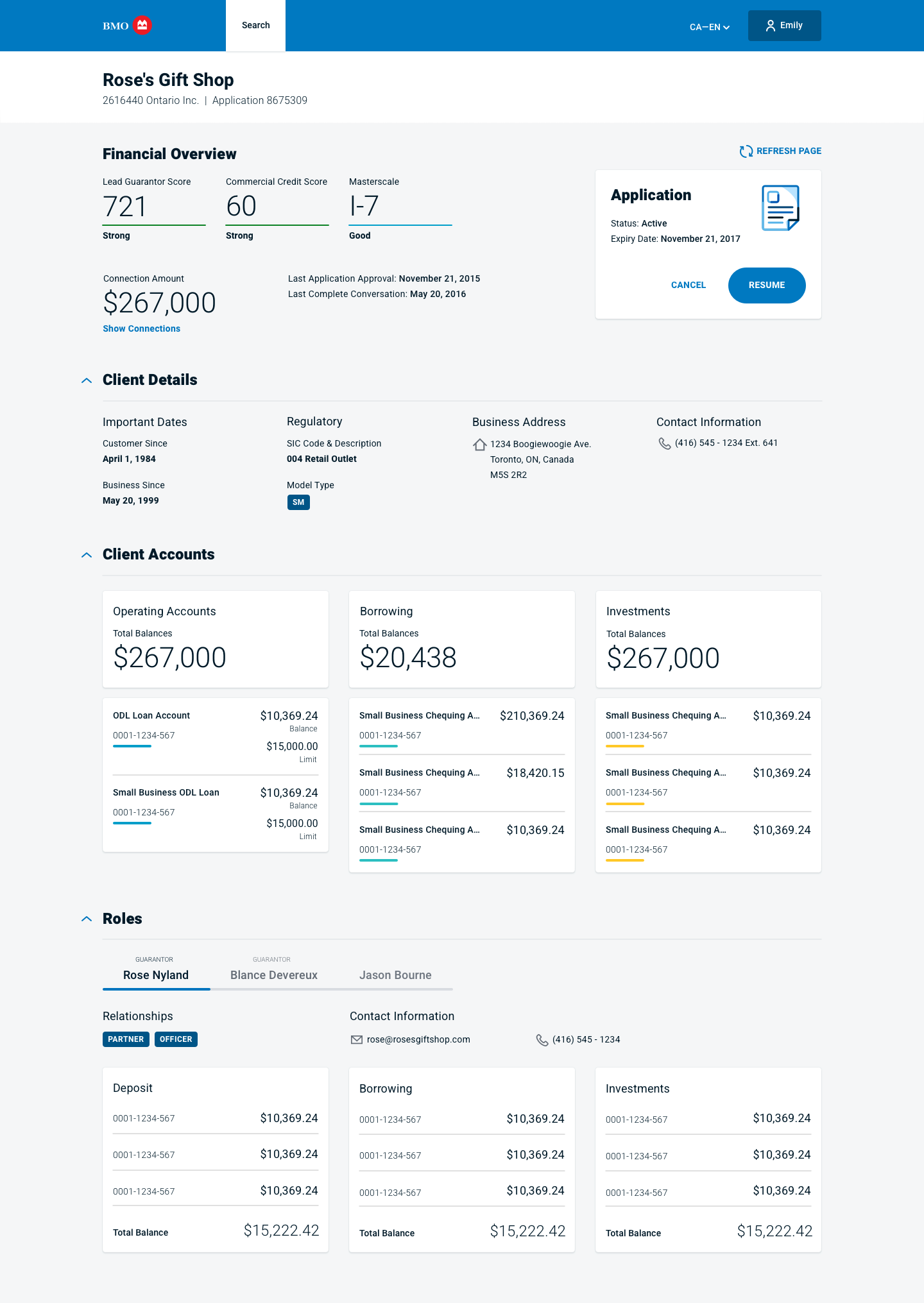

2. Client Profile

Display the most relevant client information to process an application, pulling data from 12 back-end systems.

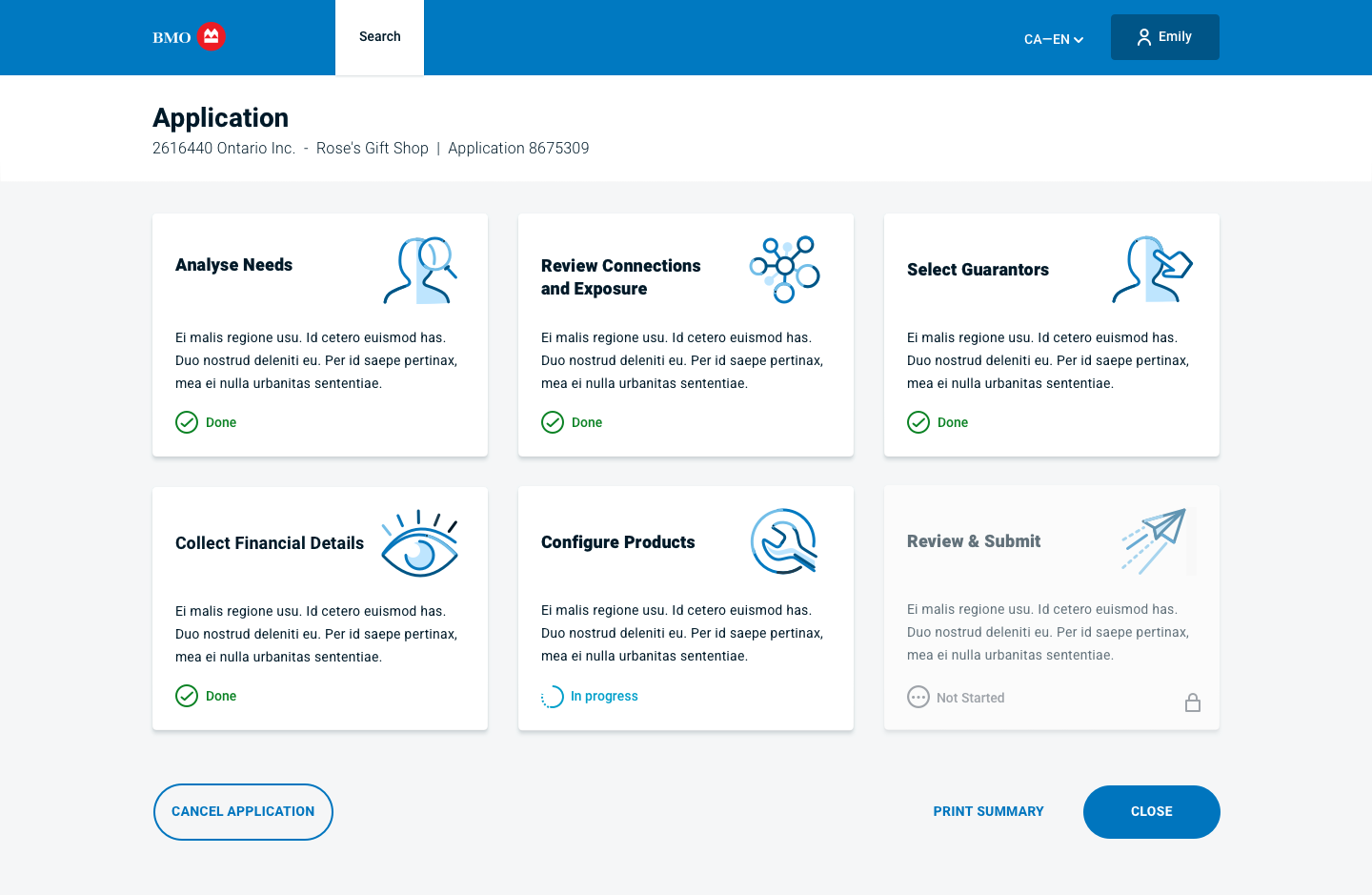

3. Application Dashboard

Allow specialists to save in-progress applications and return them later.

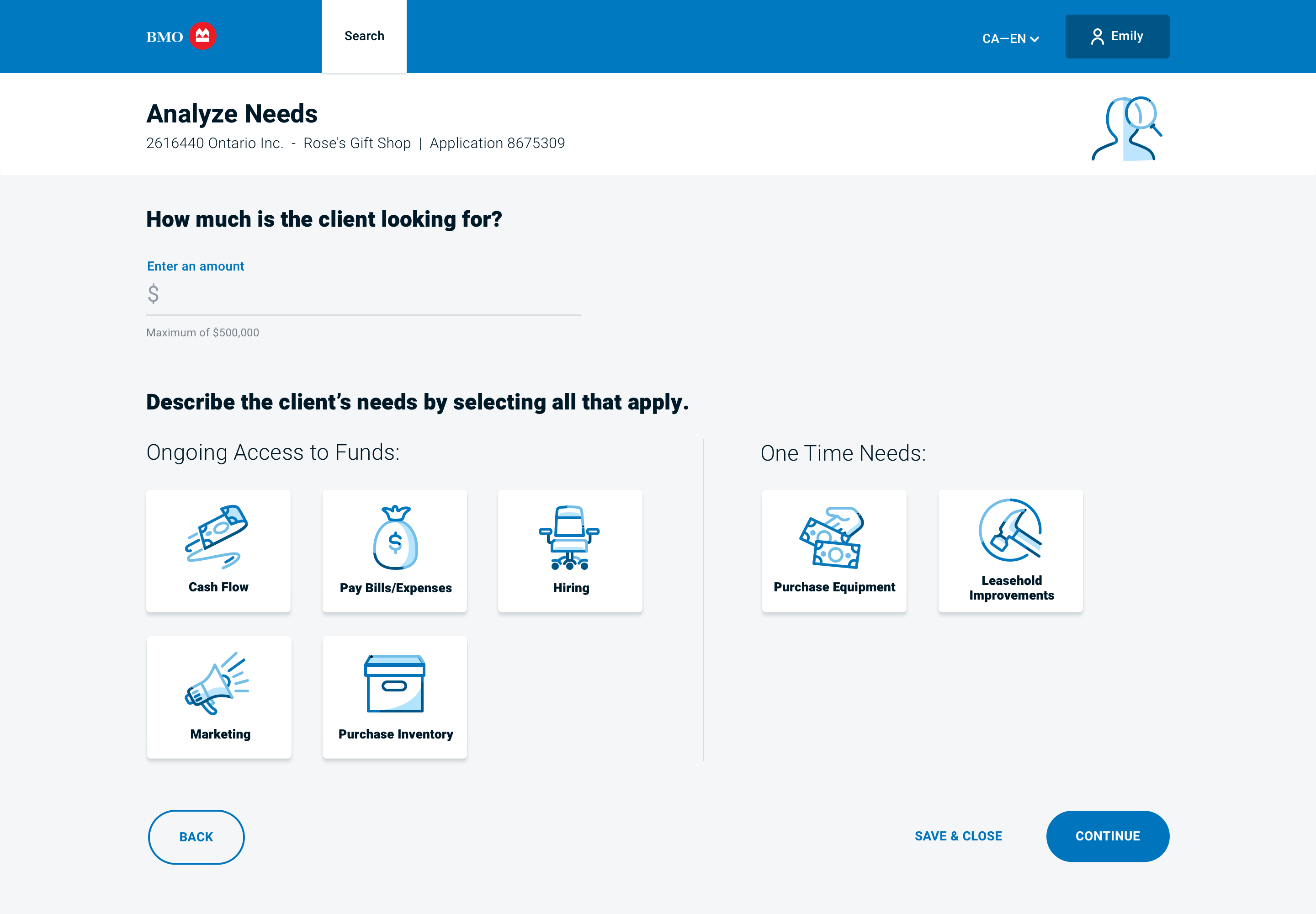

4. Analyze Needs

Capture reasons for loan requests and recommend suitable products.

5. Review Financials

Automate calculations for Authorized Limit Update and Personal Net Worth of guarantors.

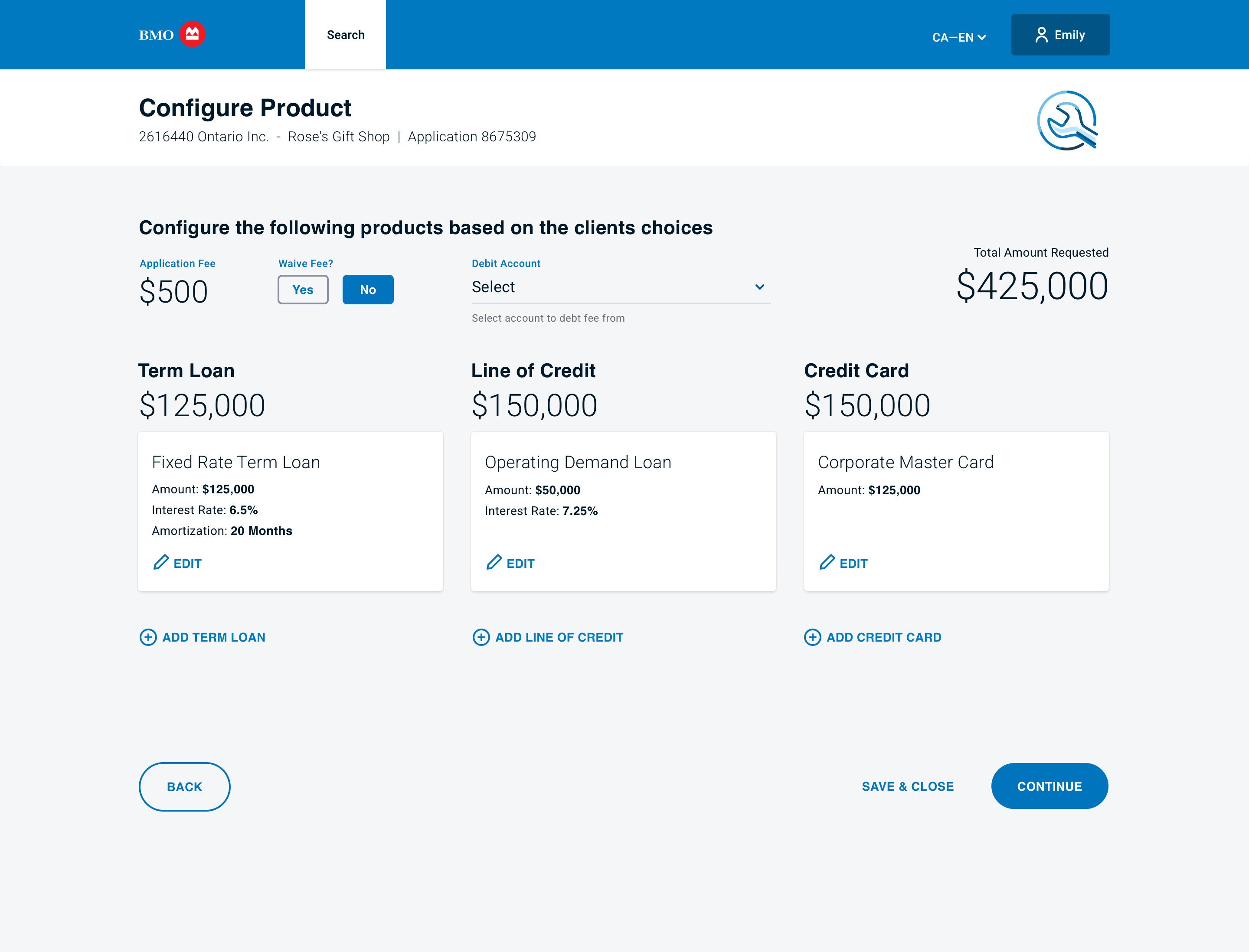

6. Configure Products

Present recommended products and amounts, allowing specialists to make changes based on customer conversations.

7. Success

Complete the application and send it to fulfillment for automatic processing and delivery.

Implementation

After designing the user flow, we developed a prototype and conducted user acceptance testing. Based on the feedback, we made the necessary changes to the design and implemented the platform for BMO Business Xpress.

Impact

BMO Business Xpress has had a significant impact on Emily (our small business banking specialist), other branch employees and business customers:

- $1 billion in new loans in the first six weeks

- 20 minutes on average time to process an application

- 4,500+ businesses served in the first year