Mobile Credit Card Dispute

BMO Bank of Montreal

Product Designer

Summary

Empowering customers to dispute a credit card charge on their own.

BMO Bank of Montreal, one of Canada's largest banks, aimed to improve the customer experience by enabling users to dispute credit card charges on their mobile banking application. This case study highlights the research, design, and implementation process behind this successful feature, significantly reducing call centre costs and increasing customer satisfaction.

Meet Krystal

Krystal is a BMO Bank of Montreal customer and has been since she's had her first savings account as a child. Now all grown up Krystal has a number of investment and banking products, including a Mastercard.

One day, she checked her statement on the BMO Bank of Montreal website and saw a charge of $99.99 that she did not recognize. She was sure that she did not make that transaction and wondered if it was a mistake or a fraud. She tapped the transaction to view more details about it and noticed a button that said “Dispute this transaction”. She was curious about this new feature and decided to give it a try and see if it could help her resolve the issue quickly and easily.

Context

BMO’s mobile banking app did not have a feature for customers to dispute credit card charges, unlike their desktop web banking. This meant that customers had to call the bank to resolve any issues with their transactions, which was inconvenient and time-consuming.

Moreover, BMO’s credit card dispute team had changed their processes since the desktop web banking experience was created and questions to handle disputes more efficiently, but the existing desktop web banking feature did not reflect these changes. Therefore, there was a need to redesign the digital experience of how customers dispute a charge and how the employees support these disputes.

Problem

How might we design a user-friendly mobile experience for BMO customers to dispute credit card charges, reducing call centre dependency and improving overall customer satisfaction?

Research

Primary research involved interviews with the BMO Customer Contact Centre dispute team and in-person usability testing with initial wireframes. This research revealed the following findings:

- Over two-thirds of testers started the flow by looking at the transaction under the credit card account view instead of a separate credit card management screen.

- Over half of the testers favoured the flow with progressive disclosure.

- All testers completed the flow with progressive disclosure over the long form.

- The disputes team shared a few questions that confused customers and provided improvement recommendations.

Design

Based on the research findings and journey maps, the following design solutions were implemented:

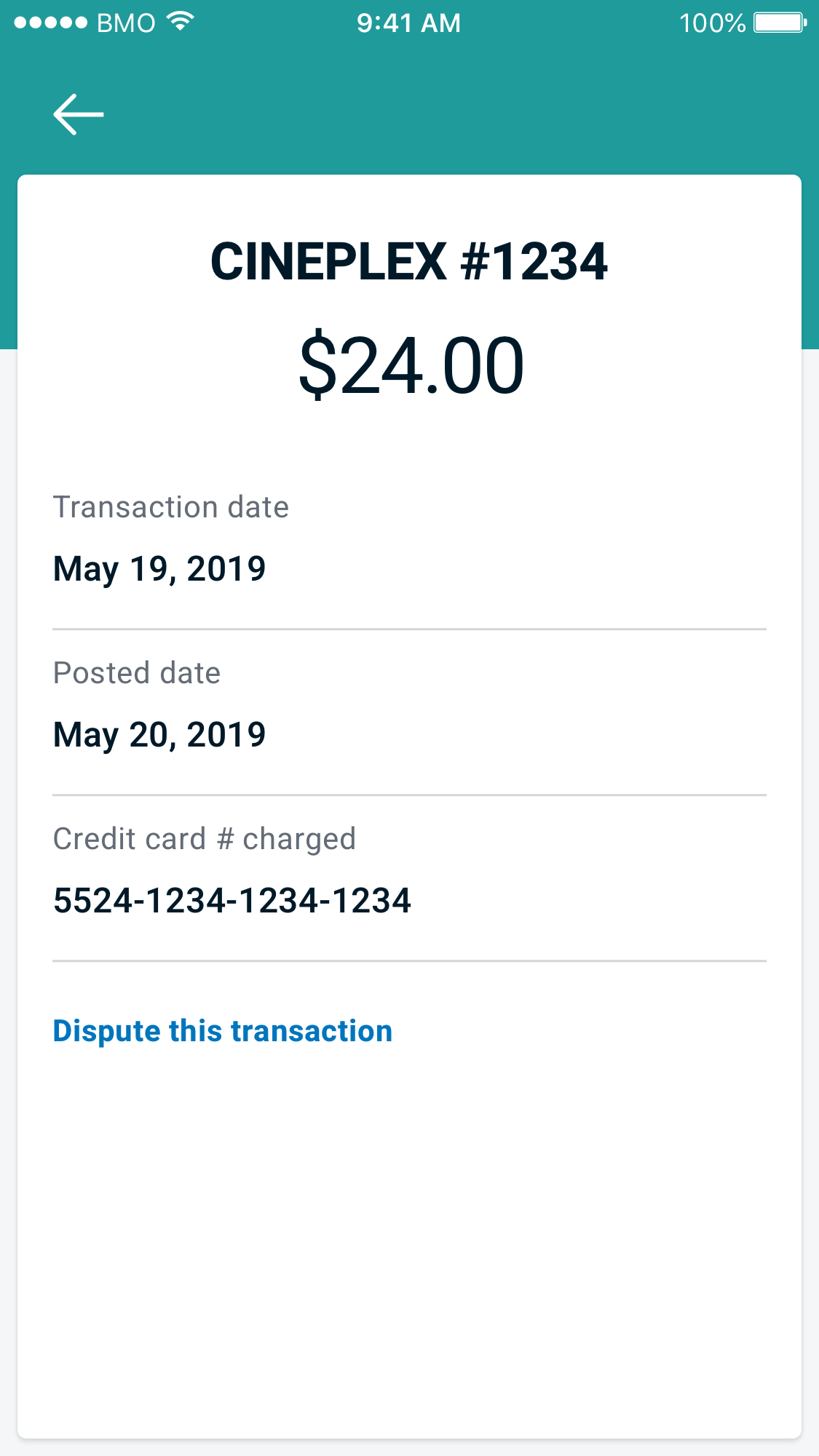

Starting a Dispute

Integrated the dispute initiation process into the transaction screen, following the mental model of most users.

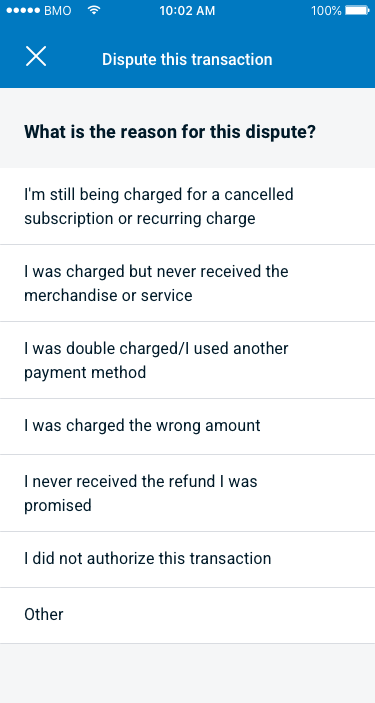

Dispute Reason

Customers provide the reason for the dispute upfront, allowing the system to load context-specific questions and determine the number of steps in the process.

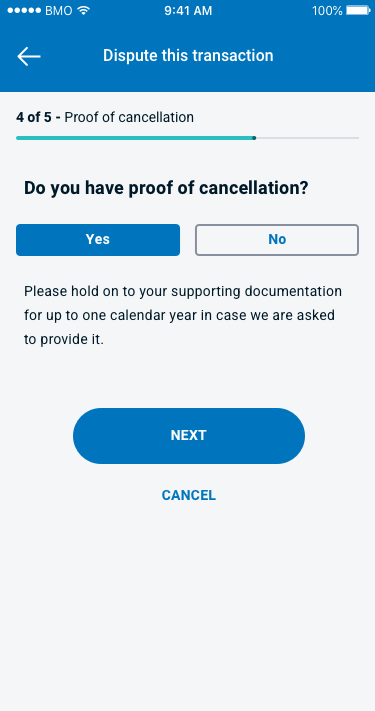

Dispute Form

- Implemented progressive disclosure was used to improve usability and reduce cognitive load.

- Managed user expectations by adding a visual overview of all the steps.

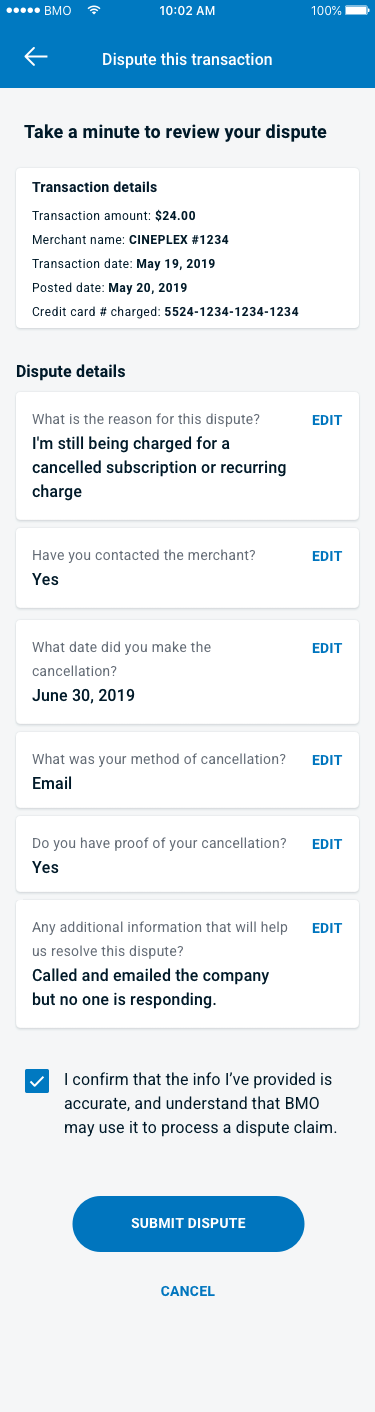

Review & Submit

Allows customers to review and edit all information before submitting the dispute, providing an opportunity to correct any errors.

Implementation

Initial wireframes were created and iterated based on user testing and dispute team feedback. The final design was then implemented in the mobile application, and user acceptance testing was conducted to ensure a seamless experience.

Impact

The implementation of the mobile dispute feature led to significant positive impacts on both users and the business:

- 25,000 customers completed a dispute digitally in the first month after launch.

- $375,000 saved in the first month alone, based on the average cost per call to the customer contact centre.

- Estimated ROI in just four months, considering the total project cost, the average cost per call to the contact centre, and feature usage.